The company’s financial restructuring process completed

As of March 31, 2018, the company had a debt of $93.1 million net of discounts and began a long-term process to address its debt managing to reduce it. The company is now trying to completely eliminate any outstanding debt and has regained its listing on The Nasdaq on January 8.

On December 20, the company entered into the December 2020 Exchange Agreement with Deerfield Lenders that will provide the completion of an equity offering of at least $40 million.

On December 23, the Company’s Board of Directors approved a 1-for-16 reverse stock split of its shares of common stock in order to potentially regain its listing on the Nasdaq exchange. By doing so the company has reduced its number of outstanding shares from 72.5 million to only 4.5 million.

On January 8, KemPharm announced the pricing of a follow-on equity offering of $50 million at a price of $6.50 per share with an issuance of a combination of common shares and pre-funded warrants to purchase 7,692,307 common shares, as well as the issuance of warrants to purchase an additional 7,692,307 at an exercise price of $6.50 per share (the Offering Warrants). This transaction closed on January 12 with net proceeds of $46.4 million.

On January 26, 2021, the Company announced a warrant exchange and inducement transaction with certain of holders of the Offering Warrants, whereby such holders agreed to exercise for cash the Offering Warrants to purchase 6,620,358 shares of the Company’s common stock in exchange for the Company’s agreement to issue new warrants (the Inducement Warrants) to purchase up to 7,944,430 shares of the company’s common stock, which is equal to 120% of the number of shares of the company’s common stock issued upon exercise of the Offering Warrants. As a result of this transaction, the company will receive gross proceeds of approximately $44.0 million.

“The successful completion of this series of transactions, culminating in aggregate gross proceeds of approximately $94 million, has allowed the Company to regain its listing on The Nasdaq Capital Market, created the opportunity to eliminate all of the Company’s debt, and has provided a substantial amount of new capital to propel the Company’s efforts to create shareholder value,” said LaDuane Clifton, KemPharm’s Chief Financial Officer. “We are now positioned with a solid balance sheet and a significantly extended cash runway that provides greater operating flexibility as we look forward to the KP415 PDUFA date on March 2, 2021,” Mr. Clifton concluded.

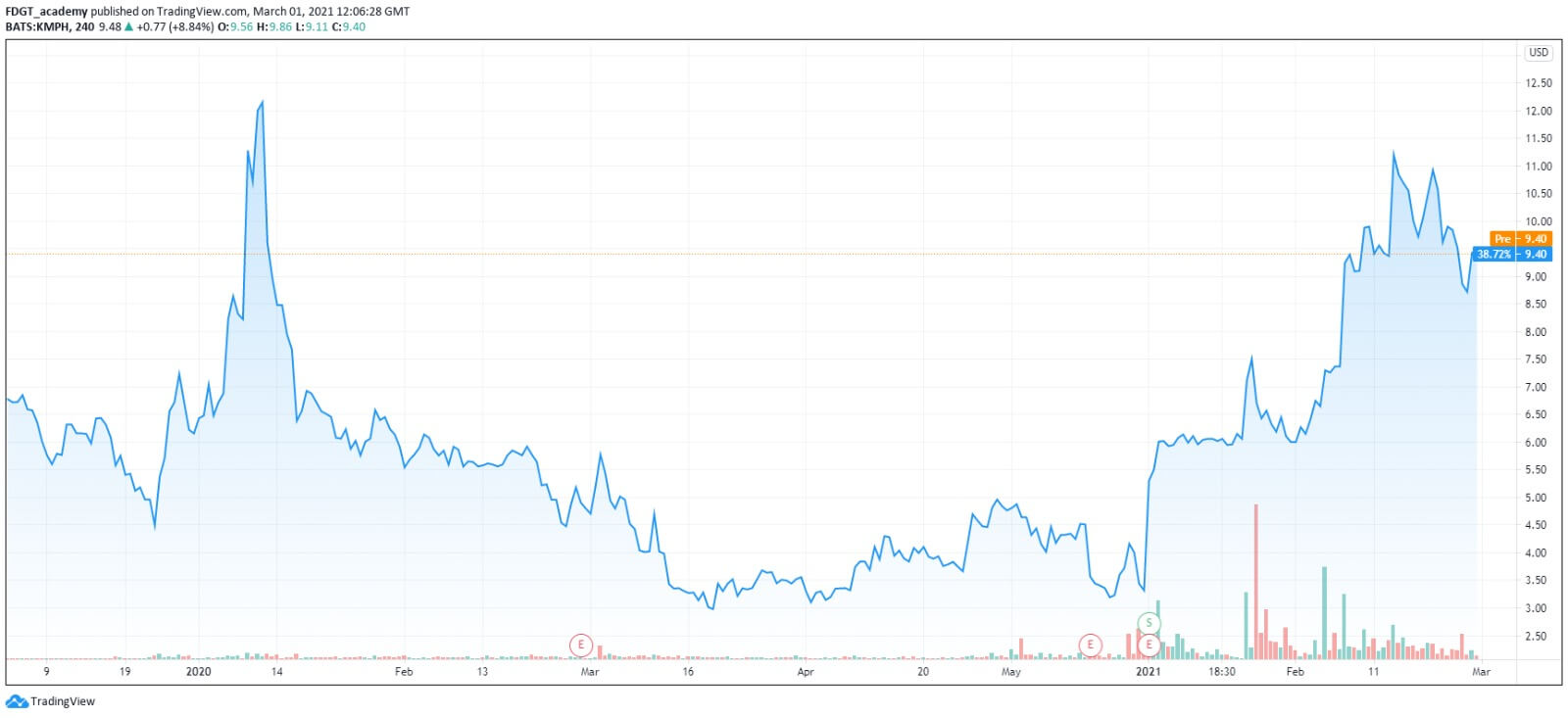

The stock price is up almost 30% in the last month since it has regained its listing on Nasdaq and also managed to get development approval from FDA for its KP879 that will act as replacement therapy for patients with SUD. To sum up, the company is showing a clear determination of accomplishing great things in order to restore investors’ value and faith.